Negatives of Blockchain Technology? Blockchain Technology has garnered widespread acclaim for its transparency, security, and decentralized nature. However, like any groundbreaking innovation, it is essential to scrutinize both sides of the coin. In this article, we’ll delve into the disadvantages of blockchain technology, shedding light on the challenges and considerations that accompany its immense potential.

Exploring the Flip Side: Disadvantages of Blockchain Technology, While blockchain confers a host of advantages, it has its not-so-friendly flanks, which relate to high energy usages, limited scalability, and complex integration with existing systems. Problems such as data immutability may result in inefficiencies, particularly when mistakes are recorded in the ledger, and the decentralized system inherently creates regulatory and legal issues.

| Aspect | Details | |

|---|---|---|

| Scalability Challenges | Decentralized nature leads to slower transactions and increased fees during high demand. Solutions include sharding, layer 2 protocols, sidechains, and efficient consensus algorithms. | |

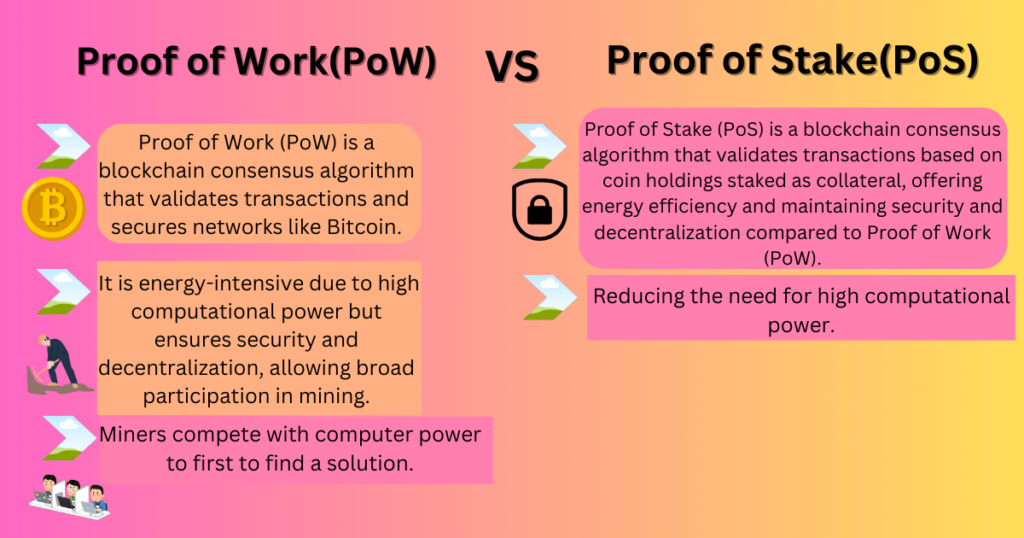

| Energy Consumption | High energy usage due to Proof of Work (PoW). Solutions include transitioning to Proof of Stake (PoS) and using renewable energy sources for mining. | |

| Regulatory Uncertainty | Lack of uniform regulations poses challenges. Solutions involve international collaboration for consistent rules and adapting legal frameworks to accommodate blockchain innovations. |

| Immutability Challenges | Irreversible transactions can be problematic for errors or fraud. Solutions include off-chain mechanisms, permissioned blockchains, and smart contract logic for exceptions. | |

| Lack of Interoperability | Different platforms hinder seamless communication and data transfer. Solutions include blockchain bridges, multichain architectures, and standardized smart contract execution (e.g., eWASM). |

| Cost of Implementation | High upfront costs for developing and maintaining a decentralized network. Solutions include resource optimization, choosing efficient consensus algorithms, using layer 2 solutions, robust security practices, legal compliance, and training. |

Scalability Challenges: Navigating the Troughs

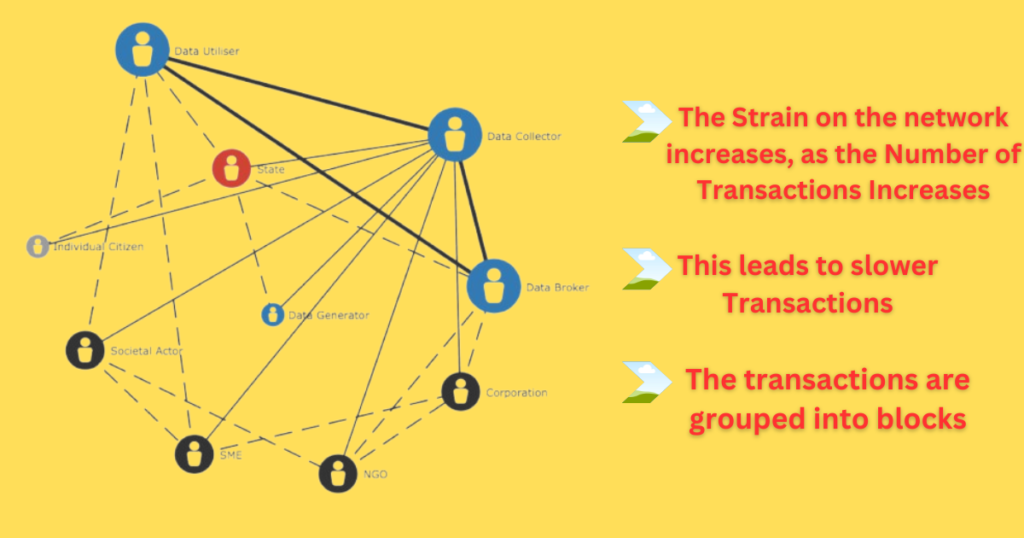

- Scalability is one of the significant challenges that blockchain technology faces. As the number of transactions increases, so does the strain on the network. The decentralized nature of blockchain, while providing security, can also lead to slower transaction processing times and increased fees during periods of high demand.

- However, this decentralized nature can lead to slower transaction processing times. Each node must validate and agree on the transaction, which takes time.

- In a blockchain, transactions are grouped into blocks. The size of each block determines how many transactions it can hold.

- As the number of transactions increases, the strain on the network grows. If the block size is limited, only a fixed number of transactions can be processed per block.

Scalability Solutions

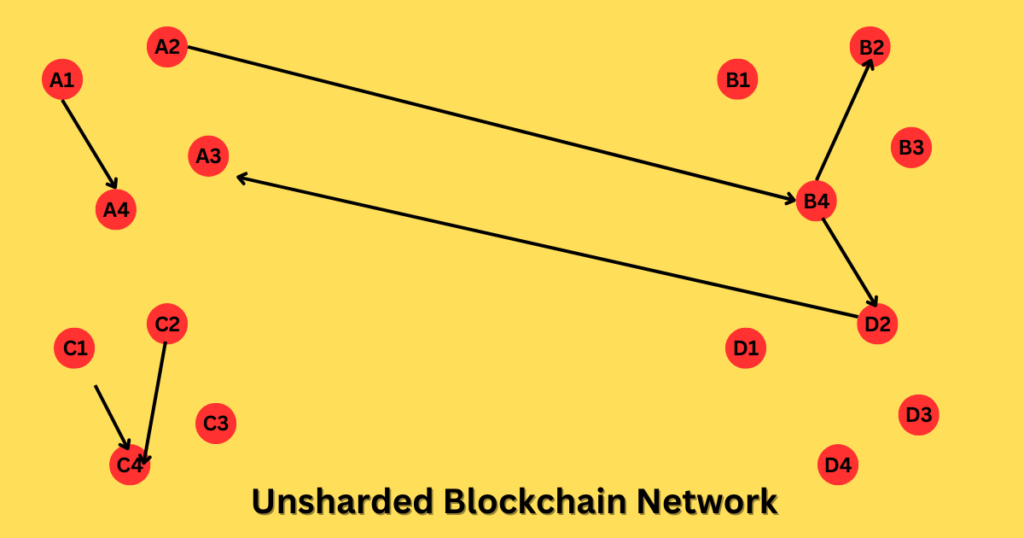

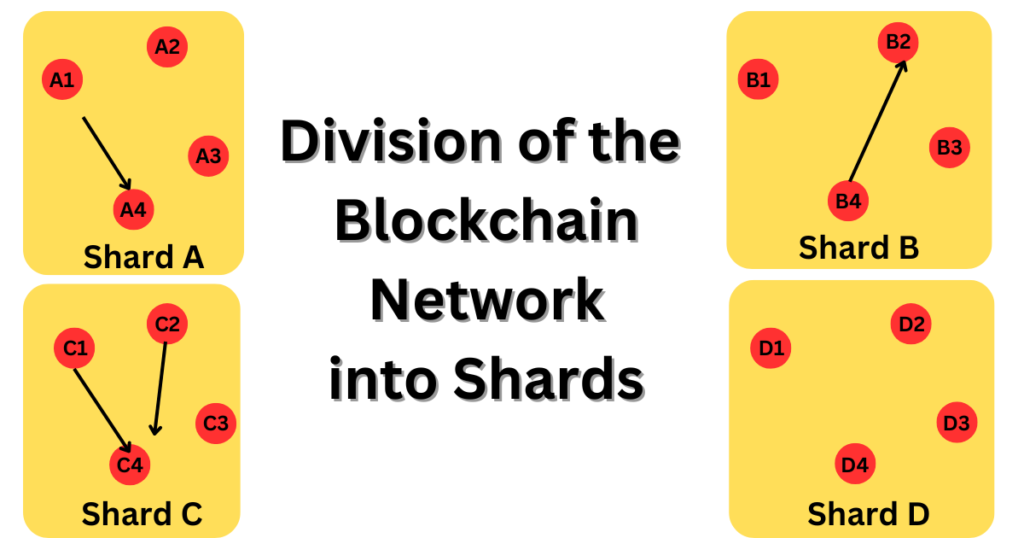

- Sharding involves dividing the blockchain network into smaller partitions (shards), each responsible for a subset of transactions. This can improve throughput but introduces complexity.

- This can improve throughput but introduces complexity.

- These are protocols built on top of existing blockchains. Examples include the Lightning Network for Bitcoin and state channels for Ethereum. They handle transactions off-chain, reducing the load on the main blockchain.

- Sidechains are separate blockchains that can interact with the main chain. They allow specific use cases (e.g., Blockchain smart contracts) to operate independently while periodically settling back to the main chain.

- Some blockchains explore consensus algorithms that balance security and scalability. For instance, Proof of Stake (PoS) and Delegated Proof of Stake (DPoS) are more efficient than traditional Proof of Work (PoW).

Energy Consumption: The Environmental Concerns

- Blockchain relies on a consensus mechanism known as Proof of Work (PoW), which requires miners to solve complex mathematical problems. This process, while ensuring security, consumes a considerable amount of energy. The environmental impact of blockchain, especially in the case of cryptocurrencies like Bitcoin, has raised concerns about sustainability.

- This process requires substantial computational power, leading to high energy consumption. Miners run powerful hardware (ASICs) that consume electricity continuously.

- The energy consumption of the entire Bitcoin network is comparable to that of some small countries. The mining process involves solving cryptographic puzzles, which requires immense computational resources.

- Miners compete to find the correct nonce (a random number) that satisfies the puzzle. The first miner to find it gets to add a new block to the blockchain and is rewarded with newly minted bitcoins.

- As the network grows and more miners join, the computational power required increases, leading to higher energy consumption.

Solutions:

- Bitcoin and some other cryptocurrencies use Proof of Work (PoW) as their validation method. It relies on computing power and resource-intensive mining.

- Transition to alternative consensus mechanisms like Proof of Stake (PoS) or Proof of Authority (PoA). Participants hold stakes (coins) to validate transactions in PoS, reducing energy consumption. PoA relies on trusted validators rather than resource-intensive mining.

- Blockchain can be used to incentivize and optimize energy-efficient transportation systems.

- Implement blockchain-based solutions for ride-sharing, logistics, and supply chain management. These can encourage sustainable practices and reduce energy consumption in transportation.

- Blockchain Developers can design blockchains with energy efficiency in mind.

- Optimize consensus algorithms, data structures, and network protocols. Consider factors like block size, transaction throughput, and validation mechanisms to minimize energy usage.

- Mining operations consume significant energy. Transitioning to renewable energy sources can make mining more sustainable.

- Encourage miners to use renewable energy (solar, wind, hydro) for their operations. This reduces the carbon footprint associated with blockchain mining.

Regulatory Uncertainty: Navigating Legal Landscapes

- Blockchain operates across borders, and the lack of uniform regulations poses challenges for its widespread adoption. The decentralized and pseudonymous nature of blockchain transactions has led to concerns about potential illicit activities, prompting regulatory bodies to grapple with how to oversee and manage this innovative technology.

- Determining which legal jurisdiction applies to blockchain transactions can be complex. Since the network operates globally, conflicts may arise when different countries have conflicting laws or interpretations.

- Existing regulations were not designed with blockchain in mind. Policymakers must strike a balance between fostering innovation and safeguarding public interests. A technology-neutral approach is essential to avoid stifling growth.

- Blockchain Smart contracts, which automate actions based on predefined rules, operate on blockchains. Ensuring their enforceability and addressing disputes requires clear legal documentation and governance frameworks.

- When things go wrong (e.g., a smart contract error), who bears the responsibility? Traditional legal concepts may need adaptation to fit blockchain scenarios.

- Protecting intellectual property rights and ensuring compliance with data privacy laws are ongoing challenges.

- The European Commission recognizes the importance of legal certainty for blockchain-based applications. It aims to create EU-wide rules to avoid fragmentation. Proposals include regulations for crypto-assets, regulatory sandboxes, and a framework for crypto-asset issuance and trading.

- The European Blockchain Partnership plans to establish a sandbox for testing innovative solutions, including data portability, Blockchain smart contracts, and digital identity.

Solution:

- Policymakers need to collaborate internationally to create consistent rules for blockchain technology.

- Harmonizing regulations across borders can promote adoption and reduce uncertainty.

- Blockchain’s decentralized nature allows transactions without intermediaries.

- Pseudonymity protects user privacy but raises concerns about illicit activities.

- Clear guidelines are needed to determine which legal jurisdiction applies to blockchain transactions.

- Regulations should accommodate blockchain innovations without stifling growth.

- Legal documentation and governance frameworks are essential for Blockchain smart contracts.

- Traditional legal concepts may need adaptation for blockchain scenarios.

- Protecting IP rights and ensuring data privacy compliance are ongoing challenges.

- The European Commission proposes EU-wide rules for crypto-assets and regulatory sandboxes.

- Testing innovative solutions, including Blockchain smart contracts and digital identity, is planned.

Immutability Challenges: Addressing Irreversible Transactions

- The immutability of blockchain, a strength in terms of security, can become a drawback when errors or fraudulent transactions occur. Once data is recorded on the blockchain, it is challenging to alter or delete. This can pose challenges in situations where corrections or reversals are necessary.

- Immutability refers to the property that once data is recorded on a blockchain, it cannot be altered or deleted. Each block in the chain contains a cryptographic hash of the previous block, creating a secure and chronological sequence.

- Immutability ensures that historical transactions remain tamper-proof. Once a transaction is confirmed and added to the blockchain, it becomes practically impossible to change.

- Users can rely on the integrity of the data stored on the blockchain, as any attempt to modify it would be evident.

- If incorrect data is recorded (due to human error or malicious intent), it remains permanently etched in the blockchain. There’s no straightforward way to correct it.

- Situations may arise where corrections or reversals are necessary (e.g., accidental transfers, fraudulent activities). However, due to immutability, undoing a transaction becomes complex.

- Legal disputes or regulatory changes may require adjustments to recorded data. Immutability can hinder compliance efforts.

Mitigating Immutability Challenges:

- Some blockchain applications use off-chain mechanisms (external databases) to handle mutable data while maintaining the core blockchain’s immutability.

- In permissioned blockchains, trusted parties can modify data selectively, addressing specific use cases.

- Blockchain Smart Contracts can include logic for handling exceptional cases, enabling reversals or corrections.

Lack of Interoperability: Bridging the Divide

- A multitude of platforms and protocols, each with unique features, characterize the blockchain ecosystem. However, the lack of standardization and interoperability between these platforms can hinder seamless communication and data transfer, limiting the potential for widespread collaboration.

- The Interoperability Trilemma:

- Each blockchain operates based on its specific rules (protocols) for consensus and security.

- Transactions within a blockchain are verified natively. When a transaction crosses chains, existing rules cannot verify it.

- Decentralized applications (dApps) rely on their base chain (layer 1) for verification. However, routing transactions between dApps (layer 2) across different chains is challenging.

Solutions for Connecting Blockchains:

- Building bridges between blockchains is complex due to differing protocols.

- Some projects use off-chain mechanisms to handle mutable data while maintaining blockchain immutability.

- Trusted parties can modify data selectively in permissioned blockchains.

- State channels and sidechains allow reversible transactions without compromising the main blockchain’s security.

- Blockchain Smart Contracts can include logic for handling exceptional cases.

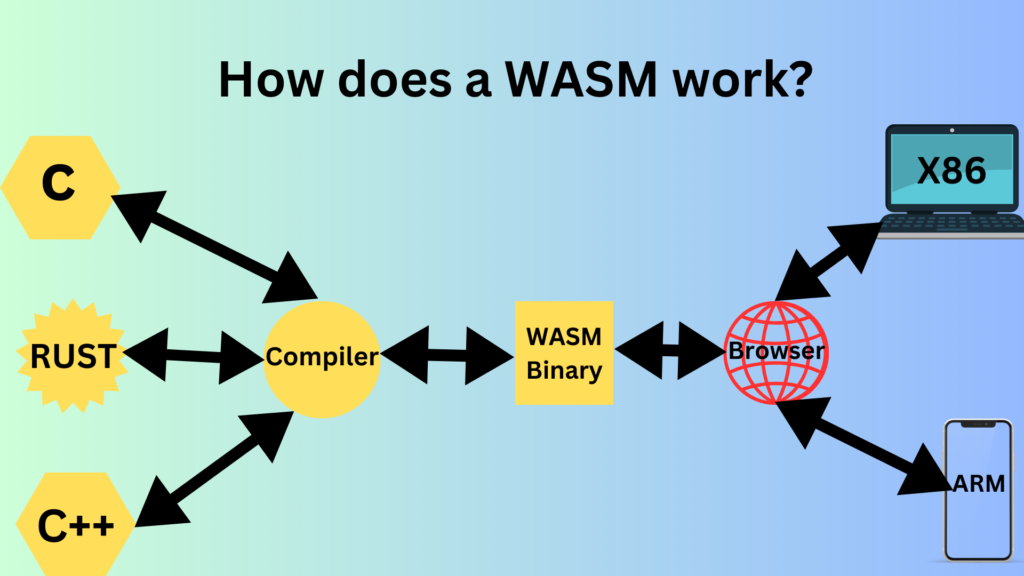

- Ethereum WebAssembly (eWASM) aims to standardize smart contract execution across different blockchains.

- Multichain architectures create a network of interconnected chains to allow interoperability.

- Blockchain bridges introduce security risks. Ensuring trustless communication is essential.

- Privacy must be maintained during cross-chain transactions.

How eWASM Works?

- Blockchain Developers write blockchain smart contracts in languages that compile to Wasm (e.g., Rust).

- These contracts are deployed on the Ethereum network using eWASM-compatible clients.

- Nodes interpret the Wasm bytecode to execute the contracts

- eWASM’s design ensures compatibility with existing Ethereum tools and infrastructure.

Cost of Implementation: The Initial Investment

- Implementing blockchain technology can come with a substantial upfront cost. Developing and maintaining a decentralized network, securing nodes, and ensuring compliance with evolving regulations demand significant financial investments. This cost may be a barrier for smaller enterprises or startups looking to leverage blockchain.

- Building a blockchain network involves setting up nodes (computers) that validate transactions and maintain the ledger. Each node requires hardware, storage, and network resources.

- Implementing consensus algorithms (e.g., Proof of Work, Proof of Stake) demands computational power and energy consumption.

- Developing blockchain smart contracts (self-executing code) requires skilled Blockchain Developers and thorough testing.

- Deploying contracts on the main blockchain (e.g., Ethereum) incurs gas fees.

- Securing nodes against attacks (e.g., DDoS, malicious code) is critical.

- Regular security audits ensure robustness but come with costs.

- Adhering to evolving regulations involves legal consultations and compliance efforts. Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures add costs.

- Training staff on blockchain technology and best practices is essential.

- Educating stakeholders about blockchain benefits and risks.

- Regular maintenance, bug fixes, and upgrades are necessary.

- As the network grows, scalability solutions (e.g., sharding, layer 2) may be needed. Smaller businesses may struggle with the upfront costs. Fear of investing without guaranteed returns. Prioritizing blockchain over other business needs. Larger players may dominate due to their financial muscle.

Solution:

- Consider cloud-based solutions or shared infrastructure to optimize resource allocation. Smaller businesses can collaborate to pool resources.

- Reduced upfront costs and efficient resource utilization.

- Choose the consensus algorithm wisely based on your network’s goals. Proof of Stake (PoS) consumes less energy than Proof of Work (PoW).

- Lower energy consumption and faster transaction validation.

- Hire skilled Blockchain Developers and conduct thorough testing. Consider using established frameworks like Solidity.

- Reliable Blockchain smart contracts and minimized vulnerabilities.

- Explore layer 2 solutions or sidechains to reduce gas fees. Plan for costs during deployment.

- Cost-effective contract deployment.

- Implement robust security practices, including firewalls, encryption, and regular audits.

- Protected nodes and reduced risk of attacks.

- Consult legal experts and stay informed about evolving regulations.

- Avoid legal issues and maintain compliance.

- Invest in automated KYC/AML tools to streamline the process.

- Efficient compliance without excessive costs.

- Train staff and stakeholders on blockchain technology and its benefits.

- Informed decision-making and smoother adoption.

- Allocate resources for regular maintenance, bug fixes, and upgrades.

- Stable network performance and enhanced features.

- Explore sharding, layer 2 solutions, or interoperability protocols.

- Accommodate network growth without compromising performance.

- Educate stakeholders about blockchain’s potential and address concerns.

- Informed decisions and alignment with business goals.

- Collaborate with other businesses or focus on niche markets.

- Strategic positioning and differentiation.

This above article has a reference of the article from, the website, ‘101 Blockchains’, blogpost, ‘Disadvantages of Blockchain Technology’ with link, ‘https://101blockchains.com/disadvantages-of-blockchain/’

- The number of followers of @blockchain on Twitter is 1.3M.

What are the main disadvantages of blockchain technology?

The main drawbacks include high energy consumption, scalability issues, lack of regulation, slow transaction speeds, and potential misuse in illegal activities.

Why is blockchain criticized for its energy consumption?

Blockchain systems like Bitcoin use proof-of-work (PoW) consensus mechanisms, which require immense computational power and energy to validate transactions, raising environmental concerns.

What is the scalability problem in blockchain?

Blockchain networks often struggle to handle a large volume of transactions simultaneously, leading to slower processing times and higher fees during peak periods.

Is blockchain technology secure?

While blockchain offers strong security through cryptography and decentralization, it is not immune to risks like 51% attacks, where a group of miners controls the majority of network power, potentially compromising the network.

How does blockchain impact data privacy?

Blockchain’s transparency can conflict with privacy concerns. Public blockchains expose transaction details, making it difficult to balance transparency with confidentiality.

Why is blockchain considered expensive?

The initial setup, infrastructure, and maintenance costs of blockchain systems can be high. Additionally, transaction fees on some networks can become expensive during high demand.

What are the regulatory challenges of blockchain?

The lack of consistent global regulations creates uncertainty. Governments struggle to address issues like taxation, legal jurisdiction, and combating misuse in fraud or money laundering.

Can blockchain be used for illegal activities?

The anonymity provided by blockchain can enable illegal activities, such as money laundering, tax evasion, and illicit trade, which raises ethical and legal concerns.

Are smart contracts infallible?

Smart contracts are only as good as the code they are built on. Bugs or vulnerabilities in the code can lead to financial losses or system failures.

Is blockchain overhyped?

While blockchain has transformative potential, some critics argue it is overhyped and not suitable for all applications due to its complexity and limitations.

Can blockchain networks be updated easily?

No, updating a blockchain (e.g., introducing new features or fixing vulnerabilities) often requires consensus from the network participants, which can be a slow and challenging process.

How does blockchain affect existing industries?

Blockchain can disrupt traditional industries, leading to job losses in sectors that rely on intermediaries, such as banking or supply chain management.