Local Area Banks (LABs) are crucial in promoting rural and semi-urban savings while providing credit for viable economic activities within specific localities. Let’s delve into the details of these unique financial institutions.

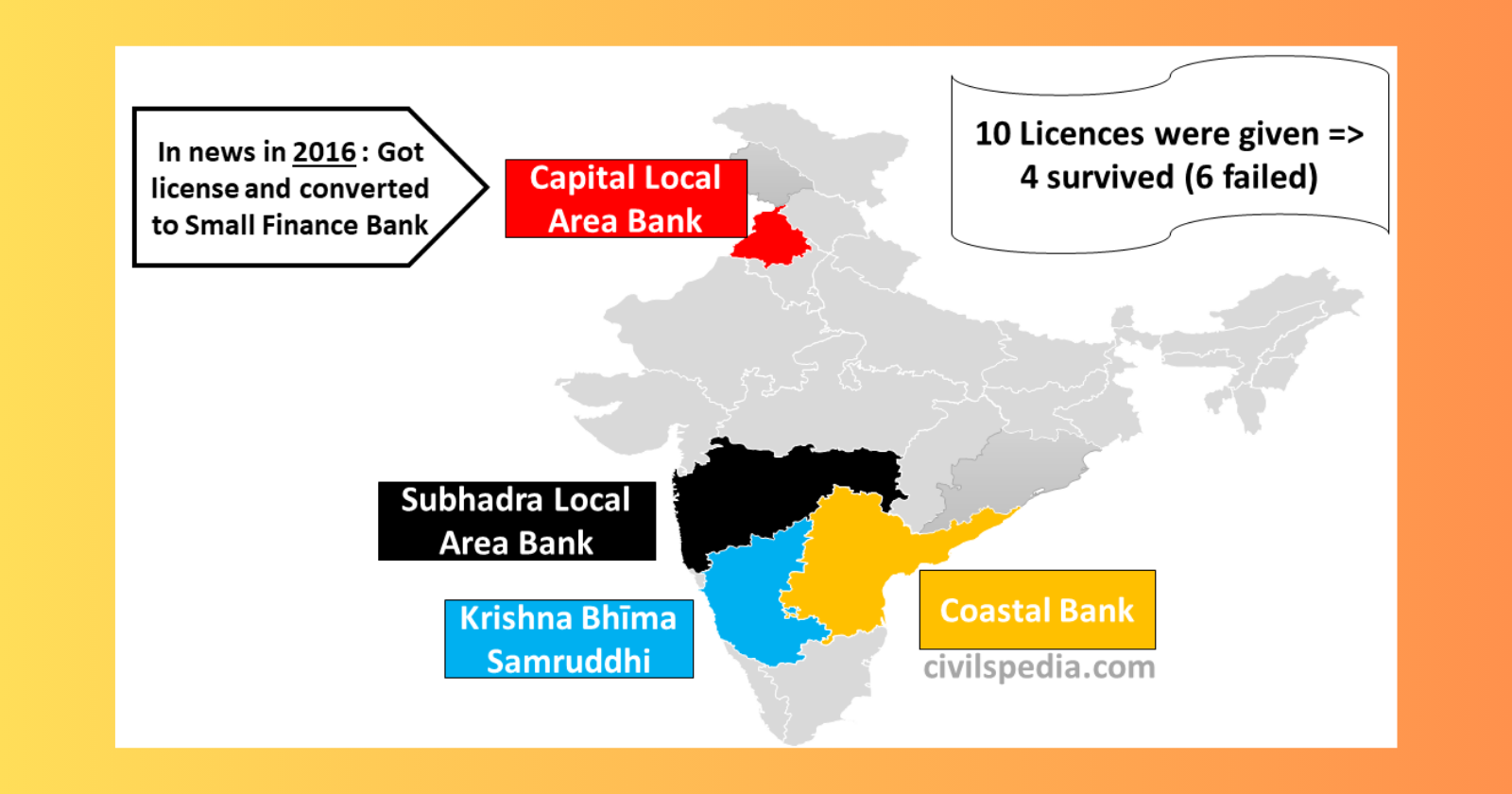

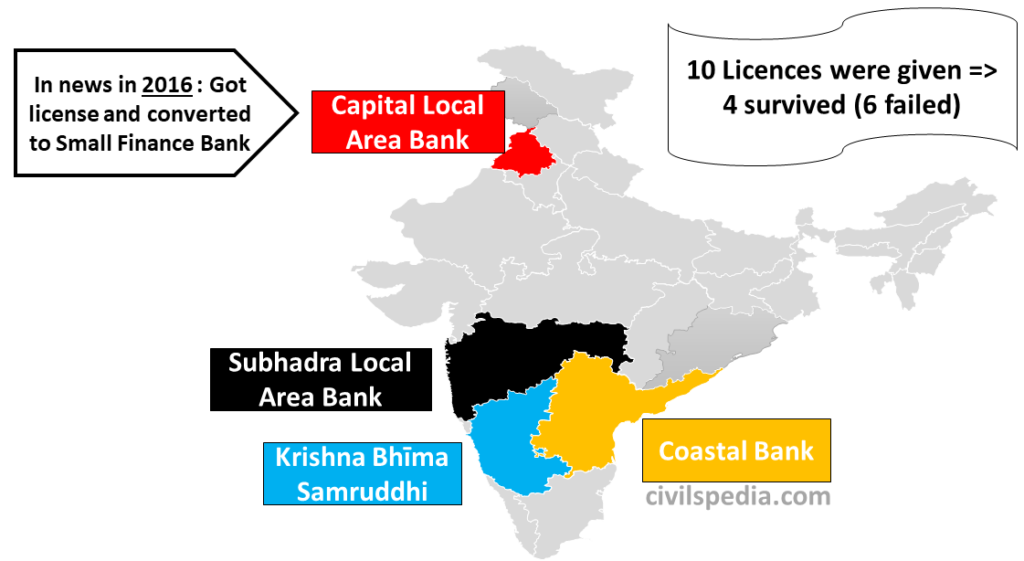

How Many Local Area Banks Are There in India? Four LABs currently operate in India, and the Reserve Bank of India licenses these banks to provide some services based on the area to promote regional economic development.

| Aspect | Details | |

|---|---|---|

| No. of LABs | 4 Local Area Banks (as of the latest data available) | |

| Names of LABs | Coastal Local Area Bank, Krishna Bhima Samruddhi LAB, Subhadra LAB, Capital LAB |

| Establishment Year | The year the LABs were established is 1996 | |

| Objective | To carry out elementary banking services in such rural and semi-urban areas where the reach is not much. |

What Are Local Area Banks?

Local Area Banks are non-scheduled banks established with the twin objectives of:

- Promoting Rural Savings: LABs provide accessible banking services, encouraging savings among local communities.

- Supporting Local Economic Activities: They offer credit facilities to support viable economic ventures within their designated areas.

Key Features of Local Area Banks:

- Geographical Focus: LABs operate within specific localities, typically spanning two or three contiguous districts.

- Capital Requirement: To set up an LAB, a minimum paid-up capital of ₹5 Crores is necessary.

- Operational Scope: LABs cater to the credit needs of local residents and businesses.

A poem in Hindi on the Local Area Banks

भारत के गांवों में छाया उजियाला, स्थानीय बैंकों की महत्वा अत्यधिक विशेष है। विकास की राह में ये बैंक खेती, उद्योग, व्यापार को सहायक हैं, साथी बनकर ग्रामीणों की आर्थिक जरूरतों को पूरा करते हैं।

जन-जन के खातों में जमा बचत, स्थानीय बैंकों की शक्ति, विकास की राह में एक महत्वपूर्ण यात्रा। गांवों की अर्थव्यवस्था को बढ़ावा देने का काम, स्थानीय बैंकों की उपाधि, गर्व से लिया जाता है।

जीवन की रूपरेखा में ये बैंक, सामाजिक समृद्धि की ओर एक कदम। स्थानीय बैंकों की शक्ति, गांवों की उम्मीद, भारत की आर्थिक विकास की यही नीति है।

Current Scenario:

As of now, India has four Local Area Banks:

- Coastal Local Area Bank Ltd

- Krishna Bhima Samruddhi LAB Ltd (KBS Bank)

- Subhadra Local Area Bank Limited, Kolhapur:

- Subhadra Local Area Bank Limited, Pune:

Coastal Local Area Bank Ltd

Coastal Local Area Bank Ltd holds a significant place in India’s banking landscape. Here’s a brief overview of its history:

- Inception: The Reserve Bank of India (RBI) licensed Coastal Bank as the first Local Area Bank in 1999. Coastal Bank aimed to cater to the banking needs of specific districts in Andhra Pradesh, namely Krishna, Guntur, West Godavari, East Godavari, and Visakhapatnam. By focusing on these areas, it could better understand local requirements and serve the community effectively.

- Commencement: It officially began its operations on 27th December 1999.

- Two Decades of Service: The bank proudly celebrates its existence for two decades, serving the local community.

- Regulation: The RBI directly regulates Coastal Bank, ensuring compliance with all supervisory guidelines.

- Mission: Its core objective is to promote financial inclusion and provide accessible banking services to the local population.

- Unique Focus: Coastal Bank caters to specific localities, emphasizing personalized service and relationship management.

- Capital Adequacy: As of March 2019, the bank maintains a robust Capital Adequacy Ratio of 21.25%.

- Services: Product offerings of Coastal Area Banks include Personal Loans, Business/SME loans, Agri business, Home loans, Kalyanamastha Loans. Kalyanamastha Loan is a unique offering to bridge the funds gap for celebrating marriages of daughters and sons.

- Mobile Banking: Recently, Coastal Bank introduced an enhanced Mobile Banking App for customer convenience.

Coastal Bank’s journey exemplifies its commitment to serving the community and fostering financial growth at the grassroots level.

- Coastal Bank has made banking services available to the regional areas and districts.

- Some highlights of Krishna, Guntur, West Godavari, East Godavari and Vishakhapatnum include infrastructure growth, agriculture and irrigation, Education and Health Care, Tourism and Culture. West Godavari and East Godavari remain agriculturally productive regions.

- Providing banking services for making finances available for the above initiatives is a major reason for establisment of Coastal Banks.

- The major challenges in these areas include unemployment, poverty, and environmental issues. Coastal Banks are less crowded and provide upliftment of the society in these areas.

For more information, you can visit their official website: Coastal Bank.

Krishna Bhima Samruddhi LAB Ltd (KBS Bank)

Krishna Bhima Samruddhi LAB Ltd (KBS Bank) is a significant Local Area Bank (LAB) operating in India. Let’s delve into its history and key details:

- Inception: KBS Bank was established as one of the first Local Area Banks in the country.

- Founding Objective: It aimed to promote financial inclusion and provide accessible banking services to local communities.

- Operational Area: KBS Bank currently operates in 12 districts across three states: Telangana, Andhra Pradesh, and Karnataka.

- Unique Business Model: What sets KBS apart is its business model. It is perhaps the only bank in India with a core objective of financial inclusion and a delivery model based on Micro Finance.

- Branch Network: As of now, KBS Bank has 29 branches and 14 Business Correspondent Outlets spread across the designated districts.

Regulation: The Reserve Bank of India (RBI) directly regulates KBS Bank, ensuring compliance with all supervisory guidelines. - Capital Adequacy: As of March 2019, the bank maintains a robust Capital Adequacy Ratio of 21.25%.

Services: KBS Bank offers a range of services, including personal loans, business loans, and housing loans.

Krishna Bhima Samruddhi LAB Ltd (KBS Bank) is a notable Local Area Bank (LAB) operating in India. Here are the key details about its current status:

Subhadra Local Area Bank Limited, Kolhapur:

- Number of Branches in India: The Reserve Bank of India canceled the bank’s license on December 24, 2020.

- Type of Bank: Local Area Bank (license cancelled).

- Reason for License Cancellation: Conducted affairs in a manner detrimental to depositors’ interests.

Subhadra Local Area Bank Limited, Pune:

- Number of Branches in India: The Reserve Bank of India canceled the bank’s license on December 24, 2020.

- Type of Bank: Local Area Bank (license cancelled).

- Reason for License Cancellation: Conducted affairs in a manner detrimental to depositors’ interests

What is the difference between Local area banks and other banks?

| Key Area | Local Banks | Big Banks |

| Convenience | Fewer physical branches, improving online presence, multiple ATM networks | More onsite locations, nationwide access through their networks |

| Safety and Security | Adhere to industry standards; often faster customer service response | Adhere to industry standards; may have slower customer service response times |

| Costs and Interest Rates | Better-than-market opportunities, adjustable interest rates, fee waivers | Monthly service fees for account maintenance, less flexibility in fee structuring |

| Community Involvement | Positive impact on local community, engage in local events and initiatives | Support community programs, focus is broader due to national/multinational presence |

Recent news on Coastal Local Area Banks.

- The RBI has imposed stricter norms on Coastal Area, Andhra Pradesh-based bank following some concerns regarding its practices. It asked the bank not to sell insurance products for reasons of credit enhancement and banned the P2P(peer to peer) platforms associated with the bank from guaranteeing recovery of loans. These measures were adopted in view of regulatory standards and in the interest of depositors and the financial system.