What is a Finance Commission? The President of India establishes a Finance Commission to address the fiscal imbalances and financial relations between the central government and the individual states within the country. The primary purpose of a Finance Commission is to recommend the principles and guidelines for the distribution of financial resources, particularly tax revenues, between the Union (central government) and the states.

| Aspect | Details | |

|---|---|---|

| Definition | The Finance Commission is a constitutional body in India formed to define the financial relations between the center and states. | |

| Established Under | Article 280 of the Indian Constitution. | |

| Purpose | To ensure a fair distribution of financial resources between the central and state governments. | |

| Tenure | Constituted every five years or at such earlier time as the President of India considers necessary. | |

| Composition | Comprises a Chairman and four other members, appointed by the President of India. | |

| Functions | 1. Recommends distribution of tax revenues between center and states. | |

| 2. Defines principles governing grants-in-aid to states. | ||

| 3. Considers measures to augment state resources to supplement panchayats and municipalities. | ||

| 4. Advises on matters referred by the President in the interest of sound finance. | ||

| Eligibility Criteria | Members should have expertise in finance, economics, public administration, or law. |

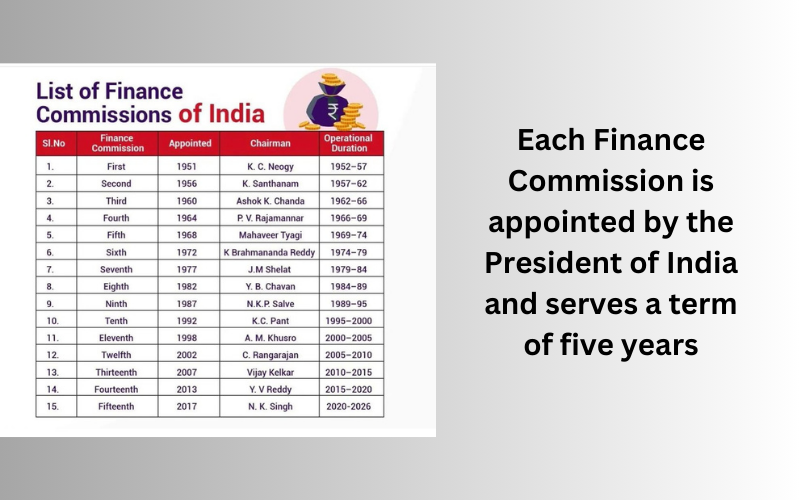

| Notable Commissions | 1. First Finance Commission (1951): K.C. Neogy as Chairman. |

| 2. Latest (15th) Finance Commission: N.K. Singh as Chairman. | |

| Significance | 1. Ensures fiscal federalism by balancing financial needs across states. | |

| 2. Plays a crucial role in equitable development and resource distribution. |

Key functions and responsibilities of a Finance Commission include:

Resource Allocation:

The Finance Commission assesses the fiscal requirements and resources of both the central government and the states. It then recommends a formula for the equitable distribution of financial resources to ensure that each state receives a fair share based on its needs and revenue-generating capacity.

In the 12th Finance commission of India, The total transfer recommended to States was Rs.7,55,751.62 crore, which included a share in central taxes and duties and grants-in-aid.

Tax Revenue Sharing:

One of the crucial aspects of a Finance Commission’s mandate is to recommend the percentage of central taxes to be shared with the states. This recommendation aims to strike a balance between the financial autonomy of states and the need for a strong central government.

The share of States in the net proceeds of shareable central taxes was set at 30.5% in the 12th Finance commission of India.

At its core, the Finance Commission aims to achieve two critical goals:

- Equalization: Imagine a seesaw. On one side, we have states with varying financial capacities. On the other, the central government. The Commission’s job? To ensure that all states receive their fair share of resources, it’s like distributing sweets at a birthday party—everyone gets a piece to balance this seesaw!

- Taxation and Expenditure Balance: Think of the Finance Commission as a financial tightrope walker. It ensures that the states’ taxation powers and expenditure responsibilities are in equilibrium. Too much on one side, and the balance wobbles; too little, and the show falters.

The Commission’s Structure

- Chairman and Members: Picture a round table where decisions are made. The President appoints a chairman and other members to the Finance Commission based on the Union Government’s advice. These appointments are like assembling a dream team for a crucial match.

- Comfort Levels and Key Positions: Here’s the human touch: The ruling party’s comfort level matters. The Commission’s effectiveness hinges on how well its members work together. It’s like a family dinner—everyone needs to get along for the meal to be delightful.

- Tenure: The President determines the specified period for the members to serve. It’s akin to a contract—fulfill your duties, contribute, and then pass the baton.

Functions of the Finance Commission

- Tax Distribution: Imagine a giant pie—the tax revenue. The Commission slices it up, ensuring each state gets its rightful portion. It’s like dividing a pizza among hungry friends—fairness matters!

- Supplementing Municipal Incomes: The Commission recommends how funds from the Consolidated Fund of India can bolster municipal incomes in states. It’s like adding extra toppings to your pizza—making it even more satisfying.

- President’s Topics: The President assigns topics to the Commission, and it dives into them like a detective following leads to crack a case.

Grants and Transfers:

The Commission suggests grants and transfers to states that may require additional financial assistance, especially those facing special circumstances or challenges. This helps address regional imbalances and supports the developmental needs of various states.

Significant grants were recommended for local bodies, calamity relief, non-plan revenue deficit, education, health, maintenance of roads and bridges, public buildings, forests, heritage conservation, and state-specific needs.

Loans:

States may also receive loans from the Centre for various developmental projects and schemes.

Debt Consolidation and Management:

Finance Commissions also provide recommendations on measures for debt consolidation and management, promoting fiscal discipline and sustainability at both the central and state levels.

The Commission recommended a debt write-off scheme and advised States to enact fiscal responsibility laws to reduce revenue and fiscal deficits.

Economic Reforms:

In addition to its primary functions, a Finance Commission actively participates in formulating policies that encourage economic growth, stability, and efficiency. This may involve recommending structural reforms to enhance the overall fiscal health of the nation.

A Journey Through Time

- First Finance Commission: Back in 1952, under the chairmanship of Shree K.C. Neogy, the inaugural Finance Commission set sail. Since then, 15 more commissions have followed, like clockwork, every five years.

- The 15th Finance Commission: Nand Kishore Singh led this commission, established in November 2017, with the mission to submit recommendations for the next five years, until March 2025.

- Central Taxes: The 15th Commission recommended that states receive 41% of central taxes. In the previous 14th Commission, it was 42%. Why the 1% adjustment? Blame it on the newly formed Union Territories of Jammu & Kashmir and Ladakh—they wanted a slice of the fiscal pie too!

When is the finance commission held in India?

Typically, the commission takes about two years to make its recommendations. For instance, the 16th Finance Commission was notified on January 30, 2024, indicating that its recommendations would cover the period following the 15th Finance Commission, which ends on March 31, 2026.

The Constitution of India mandates the constitution of Finance Commissions every five years. The President appoints a Chairman and members for each Finance Commission. The Finance Commission’s recommendations significantly impact the country’s financial architecture, influencing budgetary allocations and economic policies that drive India’s development. Difference between 15th and the 16th finance commission of India

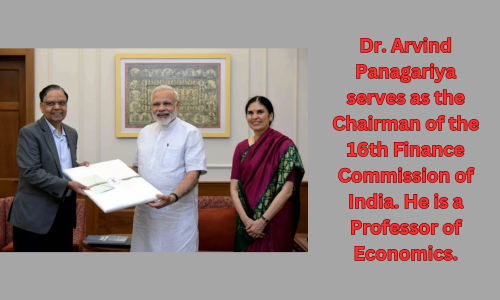

Who is the Chairman of the 16th Finance Commission?

Dr. Arvind Panagariya serves as the Chairman of the 16th Finance Commission of India. He is a Professor of Economics and the Jagdish Bhagwati Professor of Indian Political Economy at Columbia University. Previously, from January 2015 to August 2017, he held the position of the first Vice Chairman of the NITI Aayog, Government of India, in the rank of a Cabinet Minister. During his tenure, he also served as India’s G20 Sherpa and led the Indian teams in negotiating G20 Communiqués during the presidencies of Turkey (2015), China (2016), and Germany (2017). Dr. Panagariya holds a Ph.D. degree in Economics from Princeton University. If you have any more questions, feel free to ask!

| Category | Details |

| Key Areas of Focus | |

| FC15 | Focused on maintaining fiscal harmony post-COVID-19, addressing revenue sharing, and grants-in-aid. |

| FC16 | Major tasks include: |

| -Dividing tax proceeds between the Union Government and States. | |

| -Establishing principles for grants-in-aid to States. | |

| -Enhancing State funds for local bodies (Panchayats and Municipalities). | |

| -Evaluating disaster management financing structures. | |

| Criteria for Devolution | |

| FC15 | Used criteria like income distance, population, demographic performance, and forest cover. |

| FC16 | Considers factors such as income distance, area, population, and demographic performance. |

Chairperson of the 12th Finance Commission

The following article reference is taken from the Finance Commission, India: Official Website.

What are the main functions of the Finance Commission?

The primary functions include distributing tax revenues between the center and states, recommending principles for grants-in-aid, and addressing financial needs of local bodies.

How many members are there in the Finance Commission?

It consists of a Chairman and four other members, all appointed by the President of India.